Interchange Plus Pricing

You pay the true wholesale cost of each transaction set by the card networks plus a small, clearly defined merchant markup. It’s a simple and transparent model that keeps your processing costs predictable.

What Is Interchange‑Plus Pricing?

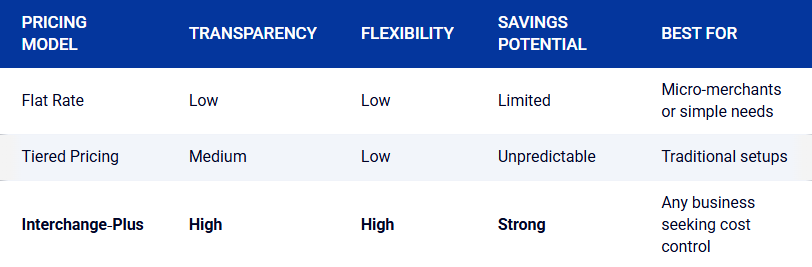

Interchange‑plus pricing is a simple, honest way to bill for credit and debit card transactions. Instead of bundling fees into confusing rates or tiers, this model breaks costs into three clear parts:

Interchange Fee – Set by the card brands and paid to the cardholder’s bank.

Assessment Fee – A small percentage charged by the card networks.

Processor Markup – A flat, transparent fee added by your payment processor.

With interchange‑plus, you see exactly what you're paying and where your money goes—no hidden rates, no surprises.

How It Works (Example)

For a $100 sale using a consumer credit card:

Interchange: ~1.65% + $0.10 = $1.75

Network Assessment: ~0.11% = $0.11

Processor Markup: 0.20% + $0.10 = $0.30

Total Cost: $2.16 (2.16%)

Most of this goes to the card-issuing bank and card network. Your processor earns only the agreed-upon markup—keeping pricing clear and competitive.

True Interchange‑Plus Pricing – No blended rates or hidden fees.

Clear Markup – We only charge a small, flat processor fee above wholesale cost.